When people start looking at investing in the Australian sharemarket, VAS vs A200 usually pop up early in their search. These are both exchange-traded funds (ETFs) that give everyday Aussies a way to invest in a whole basket of local shares with just one trade. While both aim for simplicity and diversification, there are some considerable differences you’ll want to understand before picking either one.

Introduction to VAS vs A200: What Are They?

When people start looking at investing in the Australian sharemarket, VAS vs A200 usually pop up early in their search. These are both exchange-traded funds (ETFs) that give everyday Aussies a way to invest in a whole basket of local shares with just one trade. While both aim for simplicity and diversification, there are some considerable differences you’ll want to understand before picking either one.

VAS tracks the S&P/ASX 300 Index, covering the top 300 listed companies by market capitalisation, while A200 sticks to the S&P/ASX 200, focusing just on the top 200. So, at first glance, VAS expands a bit further into the Australian market, scooping up more of the smaller listed companies, while A200 keeps things tighter and leans into the large-cap end.

Here’s a breakdown to help clear up the basics:

| Fund | Tracks | Number of Holdings | Provider | Focus |

| VAS | S&P/ASX 300 Index | ~300 | Vanguard | Broad Market |

| A200 | S&P/ASX 200 Index | 200 | BetaShares | Large Caps |

Key differences between VAS vs A200:

- VAS gives you access to 100 more companies, mostly small- and mid-caps

- A200 is known for its very low management fee

- Vanguard (VAS) has a long global record, while BetaShares (A200) is more focused on cost for local investors

For investors asking whether broader diversification really matters or if sticking with the biggest names is enough, comparing VAS vs A200 is one of those “it depends on you” moments. Getting clear on their differences is a good first step—especially when shares, through ETFs, make it easy to spread your investments and access the market at a low entry point. If you’re weighing property against shares, remember shares via ETFs like these excel at giving broad diversification and flexibility, as explained in this look at investment options for $400,000 in Australia shares offer more diversification.

The rest of this article will dig into how their holdings, costs, risk, and sector exposure stack up to help you sort out which option might slot best into your portfolio.

Comparing Holdings & Index Coverage in VAS vs A200

When you look under the bonnet of VAS vs A200, the most obvious difference is the total number of companies each fund holds. VAS tracks the S&P/ASX 300 Index, meaning it captures the largest 300 companies on the Australian Securities Exchange, while A200 focuses on the S&P/ASX 200 and limits itself to the top 200 by market capitalisation. This broader sweep gives VAS slightly wider market coverage, but how much does this matter in practice?

Here’s a simple breakdown:

| ETF | Number of Holdings | Index Tracked | % of ASX Market Coverage | Top 10 Holdings as % of Fund |

| VAS | 300 | S&P/ASX 300 | ~84–87% | ~45% |

| A200 | 200 | S&P/ASX 200 | ~80% | ~48% |

- VAS includes 100 additional mid, small, and micro-cap companies compared to A200.

- Both funds share the same top 10 holdings, which make up a similar but not identical chunk of total assets.

- The extra companies in VAS mean slightly less concentration in the biggest stocks, but for most investors, the effect is minimal – the smallest 100 in VAS barely move the needle for diversification or return.

For someone looking for broad market exposure and worried about missing out on tiny companies, VAS holds an edge, though most of the action is still in the top 200 stocks anyway.

If cost is also on your mind, keep in mind that VAS provides broader diversification with 300 stocks, whereas A200 includes 200 stocks and has slightly lower fees.

Ultimately, it’s about your own comfort level: do you want the broadest set of companies for that extra spread, or are you happy sticking to a leaner group with near-identical coverage?

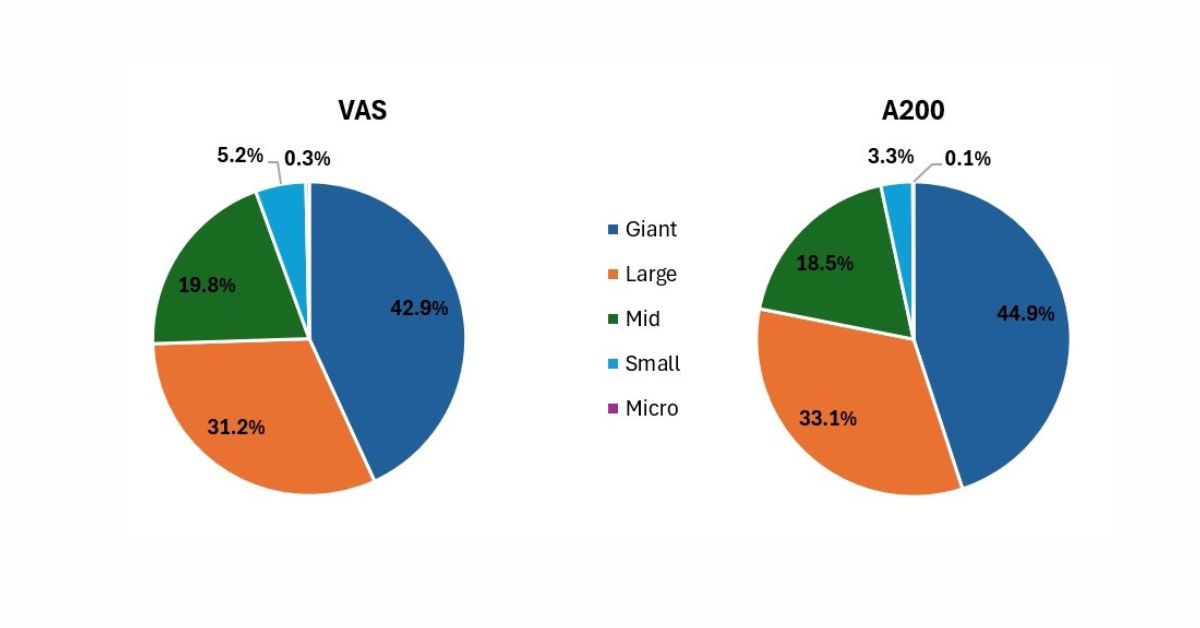

Sector & Market-Cap Concentration in VAS vs A200

When you look at VAS vs A200 side by side, the way each splits its exposure across sectors and company sizes really does shape how diversified your investment feels. VAS includes 300 companies, spreading a bit further down the list than A200’s 200 largest, but both deliver access to the giants of the Australian stock market.

Let’s break down what that means for sector and market-cap concentration:

- The top ten holdings make up around 45% of VAS and about 48% of A200—so either way, there’s a heavy tilt toward the big players.

- VAS, with its 100 extra stocks, has a small bump in exposure to mid, small- and micro-cap companies (roughly 5.5% of the fund for small caps, versus about 3.4% for A200).

- Both ETFs are dominated by sectors like financials and materials. In fact, VAS’s sector allocation shows a large chunk still tied up in these two, which shapes how the ETF rides out market moves.

Here’s a simple comparison table to frame the differences:

| VAS (ASX 300) | A200 (ASX 200) | |

| Number of stocks | 300 | 200 |

| Concentration (top 10) | ~45% | ~48% |

| Small/micro-cap weight | ~5.5% | ~3.4% |

| Largest sector exposure | Financials, Materials | Financials, Materials |

For most investors, the difference in extra diversification from VAS is small but worth noting, mainly if you care about having a bit more spread beyond the biggest 200 names.

- Both funds remain heavily focused on mega- and large-cap companies, so overall concentration risk is still high compared to global ETFs.

- The slightly higher small-cap slice in VAS may mean higher volatility, but the effect is pretty modest in practice.

- If you’re after broader exposure across more companies and a small tilt toward smaller names, VAS just edges ahead for sector and size spread, but both ETFs share similar sector risks.

Sector concentration is a reality on the ASX. Whether you go with VAS or A200, you’re still getting a portfolio where a handful of financial and resource companies call the shots. Stepping outside either of these funds is the only real way to avoid that concentration entirely.

Risk and Volatility: VAS vs A200 Under Stress

When the share market hits rough patches, sticking with a broad market ETF can help to reduce the swings in your portfolio, but no index fund is immune to volatility. VAS vs A200 trade blows pretty evenly when it comes to day-to-day fluctuations, but there are a few small differences to keep in mind.

Comparing Standard Deviation (5-Year Annualised, %)

| ETF | Volatility (%) |

| VAS | 12.7 |

| A200 | 12.6 |

With hundreds of companies inside both funds, the spread between the highest and lowest performing shares gets ironed out most of the time. The table above shows nearly identical volatility—VAS has a very minor bump, mainly because it includes about 100 extra small-cap stocks beyond the largest 200 that appear in A200. These smaller firms can wobble more during stress, but in practical terms, the gap is close to a rounding error.

When markets fall sharply or big money moves out of blue-chip stocks, you might see:

- Both ETFs track the market’s swings quite faithfully

- Slightly higher upswings or downswings in VAS due to extra smaller companies

- Major bank or mining shocks affect both funds similarly, since large companies still dominate both portfolios

While the difference in volatility between these two ETFs is almost negligible for most investors, portfolio size, time horizon, and personal tolerance for swings could make VAS or A200 a better fit for your situation.

Having A200 as a major part of a fund’s holdings, like with HVST’s investment mix, reveals that fund managers often lean on the stability that both of these ETFs provide. Ultimately, risk exposure comes down to whether those tiny portfolio differences matter for your investment goals in tough markets.

Costs, Fees & Tracking Error in VAS vs A200

When weighing up VAS vs A200, cost is at the front of most investors’ minds. After all, small fee differences can snowball over decades. Here’s how the numbers stack up:

| ETF | Management Fee (MER/TCR) | Typical Tracking Error |

| VAS | 0.07% | Very low (0.05–0.10%) |

| A200 | 0.04% | Very low (0.05–0.10%) |

A200 edges ahead as the lowest-cost Australian shares ETF currently available, charging just 0.04% per year versus VAS at 0.07%. With both funds, you’re paying less than $10 for every $10,000 invested annually, but that tiny gap can compound into meaningful savings for a long-term investor.

Key things to keep in mind about cost and tracking error:

- Management fee is just one part of what you’ll pay; transaction costs depend on the broker you pick –some platforms are cheaper for buying, others for selling.

- Tracking error for both is minimal, so both funds shadow their indexes almost perfectly.

- Over 10–20 years, a 0.03% annual fee difference can add up, though for most investors, it’s rarely a dealbreaker on its own.

Even though fees for VAS vs A200 are among the lowest in the market, it’s smart to remember that other factors—like how you plan to invest and your desired market exposure—can matter just as much as a few dollars saved on management costs.

Historical Performance & Return Consistency: VAS vs A200

When you’re looking at ETFs like VAS vs A200, weighing up long-term returns always makes sense. Both have been popular for good reason—and they track the biggest shares on the Australian market. But how do they really stack up over time?

Here’s a snapshot comparing their annualised returns and volatility over recent years:

| ETF | 3-Year Avg Return | 5-Year Avg Return | 5-Year Volatility (Std Dev) |

| VAS | 6.53% | ~7.8% | 12.7% |

| A200 | 6.79% | ~7.9% | 12.6% |

Returns and volatility data as at 31 August 2025. Past performance is not always an indicator of future results (top Australian ETFs to consider).

- Both ETFs have achieved pretty similar average returns over 3- and 5-year periods.

- A200 slightly leads on pure numbers, but the gap is marginal—something most long-term investors might shrug at.

- Volatility is nearly the same, with VAS just a tiny bit higher. That small edge mostly comes from VAS’s inclusion of a few more small-cap stocks.

Don’t get too caught up in tiny differences when it comes to these numbers—in day-to-day portfolio outcomes, the consistency of both funds has been more alike than not.

The real takeaway: while historical returns might tip a little in A200’s favour, the difference is barely noticeable for most investors. The track records are strong; consistency over the medium-term has made both funds a mainstay for those chasing Australian equity exposure. With either, you’re looking at similar patterns in ups and downs, so it comes back to personal preference or your portfolio’s balance.

Which Offers Superior Diversification: VAS vs A200?

When looking at pure diversification, the most obvious difference between VAS vs A200 is how many companies each one covers. VAS goes for the top 300 stocks on the ASX, while A200 sticks to the top 200. That extra 100 companies in VAS means more variety—especially among smaller and mid-sized businesses. If you want your investments spread out as wide as possible, that really matters.

| ETF | Number of Holdings | Coverage of the ASX Market | Sector Spread |

| VAS | 300 | ~84–87% | Broader |

| A200 | 200 | ~80% | More concentrated |

Here are a few points to keep in mind when comparing their diversification:

- VAS captures a bigger slice of the market, including more mid- and small-cap names. This can lower your overall risk from single companies or sectors.

- A200 is heavier on the large, top 200 companies. It’s a narrower set but still covers the bulk of Australia’s leading businesses.

- Both funds are tilted towards the financial and resources sectors, just like the ASX itself, so neither escapes those sector skews entirely.

Even though A200 keeps things simpler and slightly cheaper, VAS does have the edge for investors who want the broadest possible exposure within the Australian market.

Of course, broader coverage isn’t always better for everyone. Some investors are fine with a focus on the big players, so the real answer might depend on how much diversification you feel you need in your portfolio.

Choosing Based on Your Portfolio Goals: VAS vs A200

Choosing between VAS vs A200 comes down to what you’re really after with your investments – and it might not be as simple as picking the one with the lowest fee. Matching an ETF to your portfolio goals can make a noticeable difference over the long run.

Here are a few things to think through:

- Are you after the widest possible coverage of the Australian market? VAS covers 300 of the biggest stocks, so you get a broader slice of the market.

- If cost efficiency is your top priority, A200 charges a slightly lower management fee and still covers about 80% of the market’s capitalisation.

- Track record also matters. Vanguard, behind VAS, is known for stability and experience, while Beta Shares offers newer, cost-focused choices.

- What’s your approach to income? Consider the different dividend yields and payout schedules. Both fluctuate with market conditions and company performance.

- Simplicity could win the day – A200 is more concentrated and easier to track for those who want less complexity in their portfolio holdings.

Here’s a concise comparison:

| ETF | Number of Holdings | Fee (approx.) | Coverage |

| VAS | 300 | 0.10% | ~84-87% of ASX |

| A200 | 200 | 0.07% | ~80% of ASX |

Often, both VAS vs A200 give investors what they want: affordable exposure to Australia’s largest companies, but subtle differences in exposure and cost can shape your investment’s growth in unique ways.

If you’re building a portfolio for global coverage as well, you may want to see how Australian-domiciled global ETFs compare. For a broader perspective on share market exposure and tax implications for local investors, check the broad international share market exposure.

You don’t have to rush the decision. Investors often revisit their portfolio priorities and may even decide there’s room for both VAS vs A200. The main point: stay focused on your goals and remember that a clear strategy beats chasing the next big thing every time.

When it comes down to VAS versus A200, there’s no one-size-fits-all answer. Both ETFs give you a simple way to get into the Australian share market, but they go about it a bit differently. VAS spreads your money across 300 companies, which means you get a bit more coverage and a wider mix of sectors. A200 keeps things tighter with 200 companies and usually wins on fees, which can be a big deal if you’re watching every dollar. Vanguard’s long history might give some peace of mind, while BetaShares’ focus on keeping costs low is hard to ignore. In the end, it’s about what matters most to you—broader exposure or the lowest possible cost. Some folks even decide to hold both. Whatever you choose, both VAS vs A200 are solid picks for building a simple, diversified Aussie portfolio.

Frequently Asked Questions

What is the main difference between VAS vs A200?

VAS invests in the top 300 companies on the ASX, giving you a wider spread across more sectors and company sizes. A200, on the other hand, focuses on just the top 200 companies, making it a bit more concentrated but simpler to understand.

Which ETF has lower fees, VAS or A200?

A200 usually has slightly lower management fees than VAS. While both are considered low-cost options, A200 is known for being one of the cheapest Australian share ETFs on the market.

Does VAS or A200 offer better diversification?

VAS offers broader diversification because it includes 100 more companies, some of which are smaller or mid-sized. This means your investment is spread out over more parts of the Australian market compared to A200.

Is there a big difference in performance between VAS vs A200?

The difference in performance between VAS vs A200 has been very small over the years. Both track similar indexes, so their returns are usually close. The slight fee difference and the extra companies in VAS can make a small impact over time.

Which ETF is better for long-term investors?

Both VAS vs A200 are suitable for long-term investing. Your choice depends on whether you prefer broader exposure (VAS) or lower fees (A200). Both are managed by well-known companies and are popular with Australian investors.

Can I invest in both VAS vs A200 at the same time?

Yes, you can invest in both VAS vs A200. Some people choose to do this to balance the strengths of each fund. However, because they hold many of the same companies, you may not get much extra diversification by holding both.